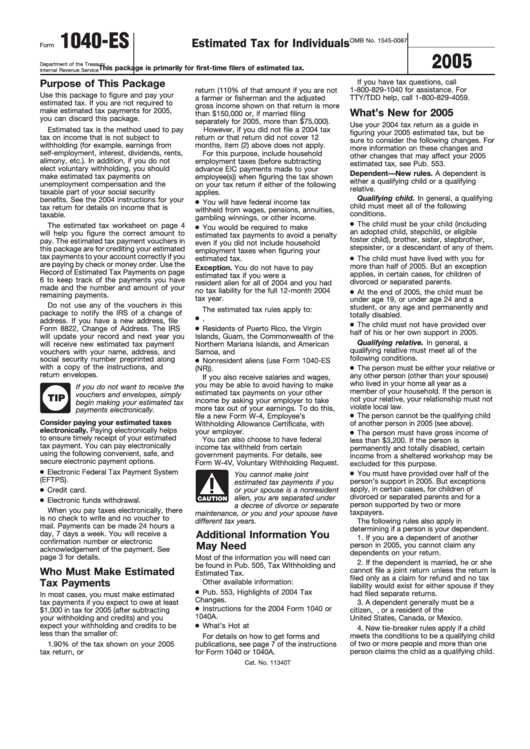

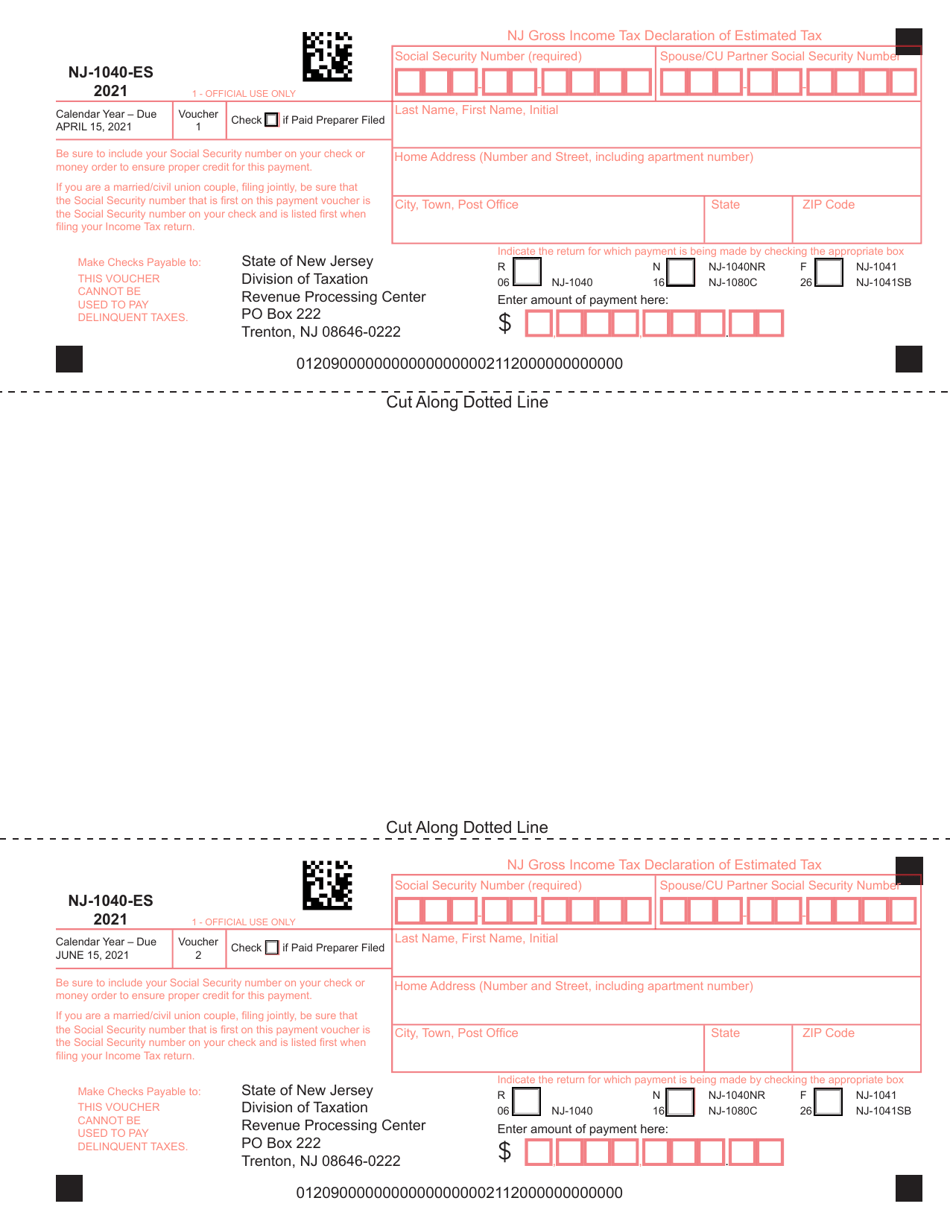

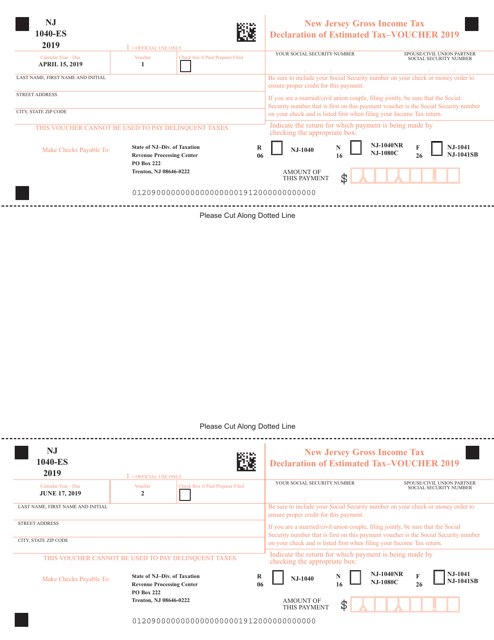

Setting up estimated tax payments by direct debitĮstimated tax payments can be scheduled with the IRS to be made by direct debit. In your PDF viewer, select File then Print.Įstimates vouchers can also be printed from the View Results menu.

If a taxpayer had a tax liability in the previous tax year, they may be required to make estimated tax payments for the current tax year. Taxpayers filing as a sole proprietor, self-employed individual, partner, or S corporation shareholder are required to pay estimated taxes if they expect to owe taxes of $1,000 or more when they file their tax return. Taxpayers who do not make required estimated tax payments, or do not have enough taxes withheld from their income, could be subject to penalties, even if they are due a refund on their tax return. If a taxpayer makes estimated payments, it should be reported on their individual tax return along with any taxes that were withheld from their sources of income. Estimated payments can also be made if a taxpayer's withholding will not cover the total amount of tax due at the end of the tax year. Estimated payments should be made on income from self-employment, interest, dividends, alimony, rental income, gains from the sale of assets, and prizes and awards. To avoid penalties, a taxpayer generally must pay to the IRS either 90% of their final tax liability, or either 100% or 110% of their prior year's tax liability, depending on their adjusted gross income. Estimated Tax Payments are required advanced payments of current tax liability based either on wage withholdings or installment payments of a taxpayer's estimated tax liability.

0 kommentar(er)

0 kommentar(er)